In our Q1-F25 quarterly webinar, Portfolio Manager Sam LaBell discusses current market conditions and compares them to the 2022 correction. He also discusses the potential impact of tariffs on global markets, including his analysis of key sectors: Canadian financials, energy sector risks, and gold markets.

Fund Performance Overview

“One thing we’re known for at Veritas is looking at the downside risk,” Sam said. “We play offence and we play defence.” Sam provides a performance overview of our three funds: the Veritas Canadian Equity Fund (long-only), the Veritas Absolute Return Fund (long-short strategy, downside capture 18%, meaning 82% of downside avoided in down quarters), and the Veritas Next Edge Premium Yield Fund (targeting 5% annualized yield).

2022 Market Correction Analysis and Current Market Comparison

Sam compares current market conditions to 2022’s correction, analyzing similarities and differences. He notes key differences including tariff impacts, the Fed’s rate path uncertainty, and higher starting yields (4.3% vs 2.85% in 2022). The analysis includes an examination of earnings estimates and market reactions during different stages of a correction. “You can’t let the volatility chase you out of the market because risk appetites will eventually return,” he said. “None of us can call the bottom perfectly, so it pays to have a little bit of risk appetite and start to add risk when you see the risk reward is shifting in your favour.”

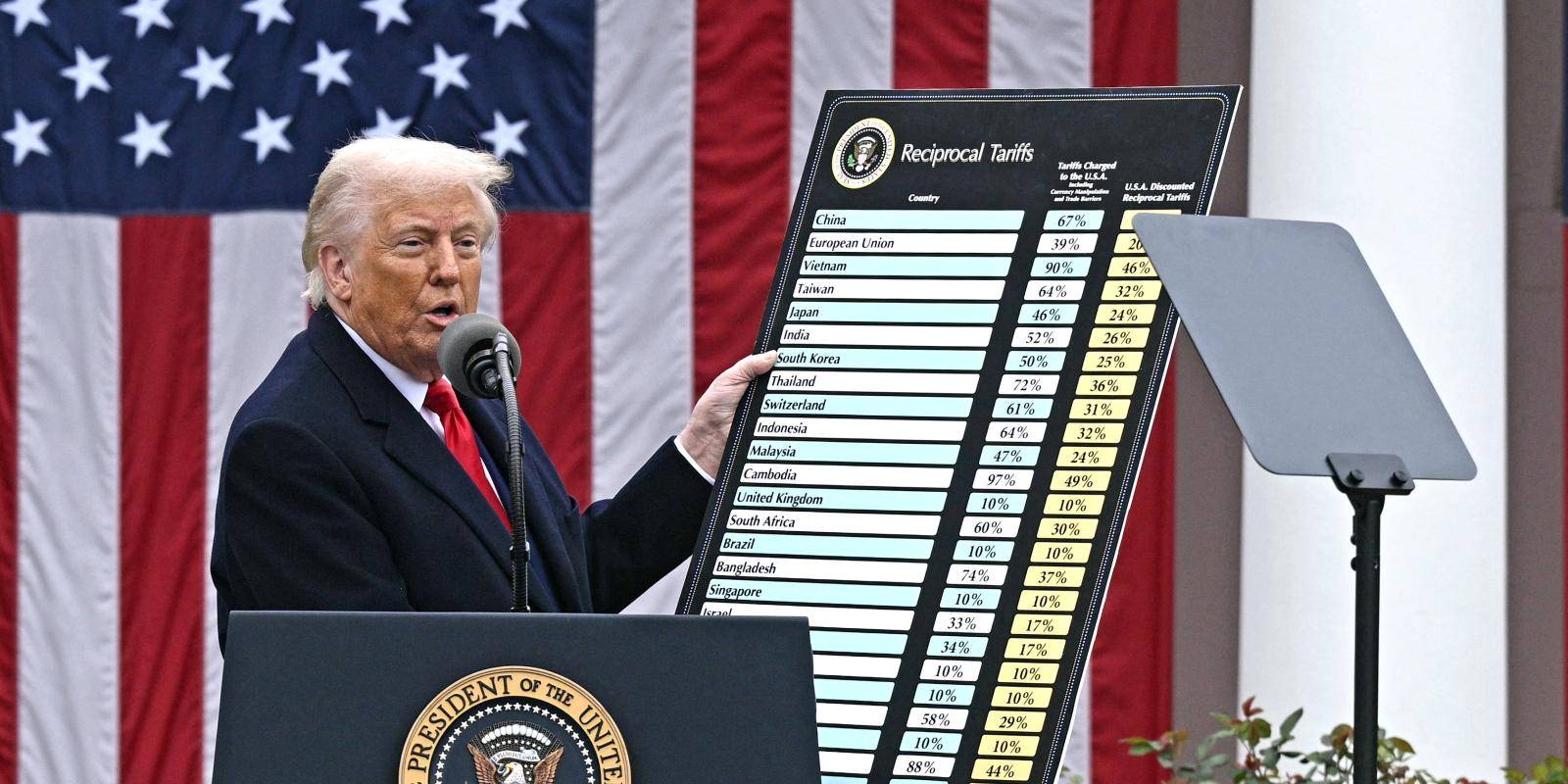

He sees pockets of opportunity in Canada, as its tariff outlook has been relatively stable compared to other countries since tariff “Liberation Day.” Although some sectors, such as autos, may be hit hard, fiscal stimulus will be released after the federal election to deal with tariff impacts.

Canadian Financial Sector Analysis

Sam shows his analysis of return on tangible book value metrics for both banks and insurers. He also shows that Canadian banks are trading at a premium to U.S. regional peers, which reflects greater concern about U.S. credit risks. He discusses his positions in Toronto Dominion Bank (NYSE, TSX: TD) and Royal Bank of Canada (NYSE, TSX: RY). “We are keeping a close eye on credit conditions and capital markets exposures because those are the things that are likely to weaken earnings going forward.”

Energy Sector Risks

Sam discusses potential risks in the energy sector, particularly regarding the impact of a global recession and global supply conditions. His analysis shows the potential for oil prices to fall below US$60 per barrel, or to US$50 per barrel in recession. He recommends shifting toward integrated names and midstream and pipeline exposure. “We’ve shifted a little bit of our exposure away from producers towards Enbridge (NYSE, TSX: ENB), TC Energy (NYSE, TSX: TRP) and South Bow (TSX: SOBO), which we think provide a nice combination of yield and a little bit of earnings growth potention.”

Gold Market Analysis and Outlook

He analyzes gold price drivers, including the relationship with the U.S. dollar, treasury yields, and S&P 500 equity returns. He examines demand trends and projects a potential gold price range of US$3,100-US$4,100, with the current price around US$3,300. “Gold may have already posted a large share of its potential climb,” he said. “There is still room for gold to move, but it’s probably not going to spike in the same way it has been spiking.”

He recommends focusing on gold producers with volume growth and low geographic/operational risk, specifically mentioning positions in Newmont Corp. (NYSE: NEM, TSX: NGT), Agnico Eagle Mines Ltd. (NYSE, TSX: AEM), and Wheaton Precious Metals Corp. (NYSE, TSX: WPM).