In our Q2-F25 quarterly webinar, Portfolio Manager Sam LaBell discusses U.S. employment trends, retail sales, demographic challenges with aging baby boomers, and fiscal concerns with projected U.S. deficits. Sam discusses tariff impacts, valuation risks in the S&P 500 and diversification strategies to reduce volatility.

Fund Performance and Top-Performing Investments

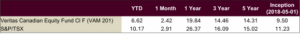

Sam outlines Veritas Asset Management Inc.’s investment approach and discusses the performance of our three principal funds: the Veritas Canadian Equity Fund (long mandate), Veritas Absolute Return Fund (long-short), and Veritas Next Edge Premium Yield Fund (targeting 5% annual yield through covered calls). Sam notes that all funds have performed well, with a significant boost from Bombardier Inc. (TSX: BBD.b), which was up ~35% in July following a major order announcement on Canada Day.

Sam details the top-performing investments across our funds. He highlights success with gold stocks, including Agnico Eagle Mines Ltd. (NYSE, TSX: AEM), Wheaton Precious Metals Corp. (NYSE, TSX: WPM), and Lundin Gold Inc. (TSX: LUG), explaining our strategy of mixing large caps with streamers to reduce operating and geographic risk. Sam discusses other successful positions, including short positions. In the Absolute Return Fund, the goal is to find a portfolio of names that will underperform the index, making money on the spread between outperforming longs and underperforming shorts.

U.S. Economic Conditions

Sam analyzes the U.S. economic picture, including employment data showing that non-farm payroll growth has slowed to just above 1%, well below the pre-pandemic trend. Sam notes that people are working fewer hours (negative year-over-year growth in hours worked) while hourly wage growth remains strong at around 4%. “There is tightening in the labour market.” For retail sales, he shows that excluding the weak automotive component, growth remains robust at about 4% year-over-year, in line with normalized trends.

Demographic and Fiscal Challenges

Sam discusses demographic challenges as baby boomers retire, showing that the ratio of retirement-age population (55+) to working-age population (25-54) has started to inflect downward as millennials now outnumber baby boomers. He explains that consumption patterns must shift from baby boomers to millennials, while noting that baby boomers remain the largest demographic for investment. Sam highlights that savings rates have fallen to under 4.5% from a pre-pandemic trend of over 6%, with more savings going into equity markets rather than real estate due to high interest rates. He then presents concerning fiscal projections in the U.S., with the Congressional Budget Office projecting 10 years of deficits exceeding 5% of GDP. Current consensus forecasts are for a 6.5% deficit to GDP in 2025, 6.6% in 2026, and 6.5% in 2027.

Tariff Impact Analysis

Sam provides analysis on tariff impacts, noting that the U.S. is collecting tariff revenues that annualize to about $300 billion per year. Sam calculates this represents approximately a 5.2% tax on all goods in the U.S., though the impact is unevenly distributed across sectors. When divided by nominal GDP, the tariffs represent about a 1.1% headwind on economic growth.

Market Valuation Risks

Sam examines market valuation risks, comparing the S&P 500 (trading at the 93rd percentile of historical multiples since 2010) to the S&P TSX (70th percentile). He notes that despite this valuation gap, earnings growth expectations are similar: S&P 500 at 11% for F-25 and 12.4% for F-26, versus S&P/TSX at 9.3% and 11.5% respectively. Sam illustrates the risk of multiple contraction, showing that if multiples revert (S&P 500 from 24x to 21.8x, TSX from 17.7x to 17x), the S&P 500 would underperform the TSX by about 3.7%. He presents historical data showing that when the S&P 500 trades above 24x earnings, subsequent five-year returns average only 5.1% (versus 8% overall) with higher volatility (7.4% versus 6.6%), and a 36% chance of loss (versus 16% normally). Sam argues these risks can be mitigated through diversification and better valuation selections. “Diversification is the only free lunch. It is the only thing that can get you to a better return or even a comparable return at a much lower volatility.”

Benefits of Diversification

Sam illustrates how a portfolio weighted 30% towards the Veritas Absolute Return Fund and 70% towards a Canadian ETF would have resulted in 23% lower monthly volatility with similar endpoint returns.* Sam shows that during negative quarters for the TSX, the Absolute Return Fund captured only about 18% of the downside (quarterly performance in down quarters for the S&P/TSX since September 30, 2019 inception), while the Canadian Equity Fund had a 70% downside capture ratio (quarterly performance in down quarters for the S&P/TSX since May 23, 2018 inception. ). During negative months, the Next Edge Premium Yield Fund had a 74% downside capture ratio (monthly performance in down months for the S&P/TSX since June 28, 2022 inception).**

He summarizes key messages for the second half: continue participating in equities while being prepared to pivot to reduce risk; seek global companies that offer natural hedges against single market risk; look for growth at reasonable prices; and embrace diversification across geographies and products to achieve better returns with lower volatility.